A broke but significant-prospective college scholar who requirements the additional resources to finance a temporary shift to a brand new site where by they are able to possibly rating a prestigious career and immediately become a significant earner to repay the loan.

In advance of buying any loan, it’s a smart idea to use a loan calculator. A calculator may help you slender your quest for a home or car by exhibiting you just how much you can manage to pay for every month. It may help you Assess loan costs and see how distinctions in desire premiums can have an affect on your payments, Specially with mortgages.

Disclaimer: NerdWallet strives to keep its info exact and up to date. This facts can be diverse than Whatever you see after you stop by a economical institution, support service provider or distinct merchandise’s site. All fiscal products, procuring services and products are offered with out guarantee.

Ideal IRA accountsBest on-line brokers for tradingBest on line brokers for beginnersBest robo-advisorsBest alternatives investing brokers and platformsBest investing platforms for working day investing

Origination price: The cost a lender costs any time you get the loan to protect processing and administrative expenditures.

Although a payday loan can provide rapid cash, they’re high priced. The good news is, there are less expensive borrowing alternatives out there – even Should you have poor credit score. That can assist you, we’ve narrowed down the ideal payday loans and alternatives, which include payday cash advance applications which have been totally free to use.

Existence coverage guideLife insurance policy ratesLife insurance policy insurance policies and coverageLife insurance quotesLife insurance policy reviewsBest lifetime insurance companiesLife insurance policy calculator

Ideal credit rating cardsBest bonus give credit cardsBest stability transfer credit cardsBest travel credit cardsBest cash back again credit score cardsBest 0% APR credit score cardsBest rewards credit cardsBest airline credit cardsBest higher education college student credit score cardsBest credit cards for groceries

We look at your special economical situation and connect you with a husband or wife from our vetted network who focuses on presenting the very best Option for reducing your payments and finding you out of credit card debt.

“We’re extremely committed to not going into an government session for it,” claimed Reed, using a expression to get a closed-doorway session. “You never ever know, simply because they’re speaking about a authorized scenario, but we’re definitely gonna make an effort to do anything out inside the open up.”

Shell out Specific focus for the regular monthly payment, full curiosity prices and interest price or APR when comparing own loans.

Clear. Direct lenders of legit short-expression loans are lawfully necessary to be upfront concerning the service fees and charges more than the loan time period, and need to adhere to maximum limitations. Your loan deal must Obviously set out all relevant fees and fees.

P2P borrowers typically provide loans with a lot more favorable terms due to the rather very low chance and affordable for your P2P service providers. P2P support companies normally operate only as a result of an internet site, which can be less expensive to run than a brick-and-mortar lender or credit history union. Also, P2P company companies do not lend specifically, but act alternatively as middlemen and choose more info a little Reduce of all transactions. The lenders bear the decline when borrowers default. As a result, these P2P provider vendors function with pretty reduced possibility.

Might cause repeat borrowing: Due to the fact applications make borrowing from a subsequent paycheck straightforward, they could lead to some cycle of credit card debt when you rely on developments to include regular fees.

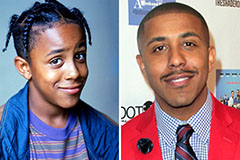

Marques Houston Then & Now!

Marques Houston Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Barbara Eden Then & Now!

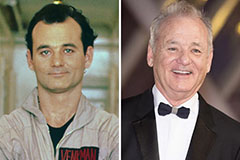

Barbara Eden Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!